Are you looking for a shipping solution? Maybe you need to change freight carriers? Find out what the hard working and reliable people at Team Worldwide can do over land, sea and air

Governor Lamont Announces Tax Reduction on Beer

(HARTFORD, CT) – Governor Ned Lamont today announced that the newly enacted state budget he signed into law last month reduces taxes on beer by 16.7%. The governor said that the tax decrease was included in the budget as part of his ongoing efforts to support the continued growth of Connecticut’s craft brewery industry and the associated jobs it generates.

A report released in May that was conducted by the National Beer Wholesalers Association and the Beer Institute found that beer brewed in Connecticut yields $2.9 billion in economic output for the state and supports 17,892 jobs with professions ranging from careers in agriculture, manufacturing, and retail. There are currently more than 120 operational breweries in Connecticut, with many more in planning.

“Connecticut’s craft brewery industry has been booming in recent years, and it is evidenced by the growth of hundreds of new jobs for our state’s residents,” Governor Lamont said. “We should be doing everything we can to support locally-owned small businesses, including craft breweries. This reduction in taxes is another way we can support them.”

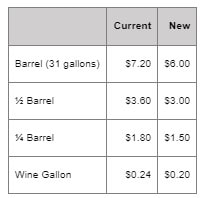

The tax reduction on beer is scheduled to take effect on July 1, 2023. The changes are as follows:

A report released in May that was conducted by the National Beer Wholesalers Association and the Beer Institute found that beer brewed in Connecticut yields $2.9 billion in economic output for the state and supports 17,892 jobs with professions ranging from careers in agriculture, manufacturing, and retail. There are currently more than 120 operational breweries in Connecticut, with many more in planning.

“Connecticut’s craft brewery industry has been booming in recent years, and it is evidenced by the growth of hundreds of new jobs for our state’s residents,” Governor Lamont said. “We should be doing everything we can to support locally-owned small businesses, including craft breweries. This reduction in taxes is another way we can support them.”

The tax reduction on beer is scheduled to take effect on July 1, 2023. The changes are as follows:

The state anticipates a $2 million revenue loss from the tax decrease.

This tax reduction comes on top of a comprehensive package of reforms that Governor Lamont signed into law in 2019 that were designed to support growth in the craft brewery industry. That package:

Read on CT.gov

This tax reduction comes on top of a comprehensive package of reforms that Governor Lamont signed into law in 2019 that were designed to support growth in the craft brewery industry. That package:

- Updated Connecticut’s outdated blue laws by increasing the amount of beer that breweries could sell to an adult for off-premise consumption from nine liters (about 1 case of 12-ounce cans) to nine gallons (about 4 cases of 12-ounce cans);

- Consolidated the four beer manufacturer permits – beer, brew pub, beer and brew pub, and farm brewery – into one permit, helping to streamline the administration of these permits and level the playing field within the industry;

- Created a Connecticut Craft Café permit, under which all manufacturing permit holders have the ability to sell all other types of alcohol in the state. (For example, wineries, cideries, and distilleries are now able to sell Connecticut craft beer); and

- Allowed craft breweries to hold multiple manufacturing permits so they can also make wine, cider, spirits, and mead all under one roof.

Read on CT.gov

Ready for reliable and friendly service in a towing company? Combined with competitive rates? Call Force 1 Towing and Auto Body in Catasauqua at 610-266-6721