Department of Taxation Informs Business Owners of Nevada Day Holiday Sales Tax Exemption for Nevada National Guard Members

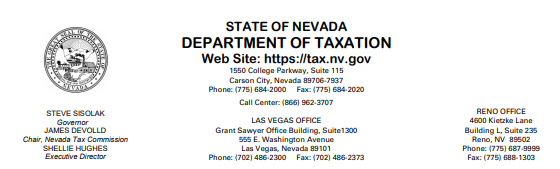

October 14, 2021 Carson City, Nevada – The Nevada Department of Taxation announces a new sales tax exemption for Nevada National Guard members over the Nevada Day holiday weekend. During the 2021 Legislative Session, Senate Bill 440 (SB440) amended NRS 372.7821 and related statutes to provide an exemption from Nevada sales tax on sales of tangible personal property to certain Nevada National Guard members and their qualifying dependents living at the same physical address in Nevada. The period of tax exemption is on the day that Nevada Day is observed and the Saturday and Sunday immediately following. Although the period to apply for the exemption has expired, many National Guard members have already applied and received their letter of exemption to present to businesses for their sales tax exemption. The criteria for the exemption applies to: 1. A member of the Nevada National Guard who is on active status, as defined in 10 U.S.C. § 101(d)(4), and who is a resident of this State, if the sale occurs on the date on which Nevada Day is observed pursuant to NRS 236.015 or the Saturday or Sunday immediately following that day. 2. A relative of a member of the Nevada National Guard eligible for the exemption pursuant to subsection 4 who: a. Resides in the same home or dwelling in this State as the member; and b. Is related by blood, adoptions, or marriage within the first degree of consanguinity of affinity to the member. Vendors who are selling tangible personal property to eligible members and their qualifying dependents are authorized to sell them as tax exempt. The Department also recommends that all vendors retain a copy of the individual’s letter of exemption to document the transaction as tax exempt. This tax exemption only applies to Nevada sales/use tax and does not provide exemption from any other tax. Any vendor who has questions concerning the exemption letter should contact the Department’s Call Center at (866)962-3707. The Department of Taxation, as an essential Executive Branch Department, is responsible for the administration of 17 different tax types, three fees, two licenses, and one civil penalty. The collection and distribution of funding supports the state general fund, the state distributive school account, local governments, and the state debt service fund. This is accomplished with 403 employees in five divisions. The Department also serves as staff to five boards and commissions.

Are you looking for a shipping solution? Maybe you need to change freight carriers? Find out what the hard working and reliable people at Team Worldwide can do over land, sea and air